Federal government pension calculator

Advisory services offered through Shilanski Associates Inc an Investment Adviser doing business as Plan Your Federal Retirement. Missouri offers the following filing options.

Revised Pension Calculator July 2022 Galaxy World

X X X 310 Foreign income tax X 311 IDA contributions X X X 314 Interest and dividends on US.

. Moreover the following previous increase in pension will cease to exist for the pensioners who will retire on or after 1 st July 2022. The government publishes new pay tables for federal employees every year. Your LGPS pension will be paid in full from your regular pension age which is related to your State pension age but at least 65 years old.

Before sharing sensitive information make sure youre on a federal government site. Learn more about the FederalPay Employees Dataset here. Learn more about the FederalPay Employees Dataset here.

IRS YouTube Videos. 10 Increase in Pension with effect from 1 st July 2017. 10 Increase in Pension with effect from 1 st July 2016.

Office of Regulations and Interpretations Employee Benefits Security Administration Room N-5655 US. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Federal employee salaries are public information under open government laws 5 USC.

2-D Barcode Filing Filing your state paper return using a barcode. These come in three flavors. Estimated Tax Payments English Spanish ASL.

However most pensions are insured by the federal government so dont harp on this too much. Department of Labor 200 Constitution Avenue NW Washington DC 20210 Attention. Federal employee salaries are public information under open government laws 5 USC.

Certain other Federal employees not covered by FERS have the option to transfer into the plan. Certain federal jobs that deal with the national security of the United States also require a security clearance. Federal pension income X.

Calculate your pension under the legacy High-3 System. FederalPay provides this data in the interest of government transparency employee data may not be used for commercial soliciting or vending of any kind. Depending on the feasibility of these estimates budgets are of three types -- balanced budget surplus budget and deficit budget.

Federal agencies contribute funds to FERS on behalf of employees in an amount defined by law. IR-2018-180 September 7 2018. Federal gain previously taxed by Oregon X X X.

Paper Long Form - MO-1040. All content on this site if for information purposes only. The PSERS Board of Trustees will conduct active-certified and retired memberparticipant elections this fall.

However you can choose to retire and take your pension from LGPS at any time between the ages of 55 and 75 provided you have completed a 2-year period of the scheme. Previous Increases in Pension Cease to Exit. As an aside unlike the federal government states often tax municipal bond interest from securities issued outside a certain state and many allow a full or partial exemption for pension income.

A lump sum payout is the more exciting option of the two. X 309 Fiduciary adjustments from Oregon estates and trusts. As per the Indian Constitutional Amendment Act 1993 the vidhwa pension was decentralized and its implementation which was handled by the Social Welfare Department of the State Government was transferred to the Local Self Government Institutions as per the revised rules of the Governments Order Number GO P 11 97 date 07041997.

No matter what method you choose your 2021 income tax return is due April 18 2022. Follow the instructions for submitting comments. Most new Federal employees hired after December 31 1983 are automatically covered by FERS.

WASHINGTON With tax reform bringing major changes for the year ahead the Internal Revenue Service today urged retirees to make sure they are paying in enough tax during the year by using the Withholding Calculator available on IRSgov. Pros and Cons of Lump Sum Pension Payouts. Pension Benefit StatementsLifetime Income.

Code and effective January 1 1987. It is fixed income for the rest of your life. You may not have to pay federal income taxes on your military pension.

That is it applies when a public sector worker opts to claim the benefits earned by their private sector spouse and then applies to receive those monthly payments. Click here for more information. And that is becoming increasingly more valuable in a world where pensions are becoming a thing of the past at least on the private side.

The IRS hosts a withholding calculator online tool which can be found on their website. X X 307 Federal income tax paid for a prior year. This means that your Social Security benefits will be reduced by 600.

FederalPay provides this data in the interest of government transparency employee data may not be used for commercial soliciting or vending of any kind. Im just going to talk about regular. Electronic Filing e-filing of your state and federal return.

See pay tables for federal employees 2022 and prior years. Thrift Savings Plan contributions are not matched by the government. Pay Scales for Federal Employees.

Federal eRulemaking Portal. The president and Congress decide how much if any pay raise federal workers will receive in the next calendar year. The site is secure.

A government budget is an annual financial statement which outlines the estimated government expenditure and expected government receipts or revenues for the forthcoming fiscal year. Confidential Secret and Top SecretThe SF-86 form is used by the government to collect information on employees applying for a security clearance and initiate the process. Learn more about federal pay and.

For example if you have a government pension of 900 your Government Pension Offset is 600 900 x 23. Use that information to update your income tax withholding elections on our Services Online retirement tool. The Government Pension Offset GPO is a Social Security rule that affects workers with government pensions who also receive Social Security spousal or survivor benefits.

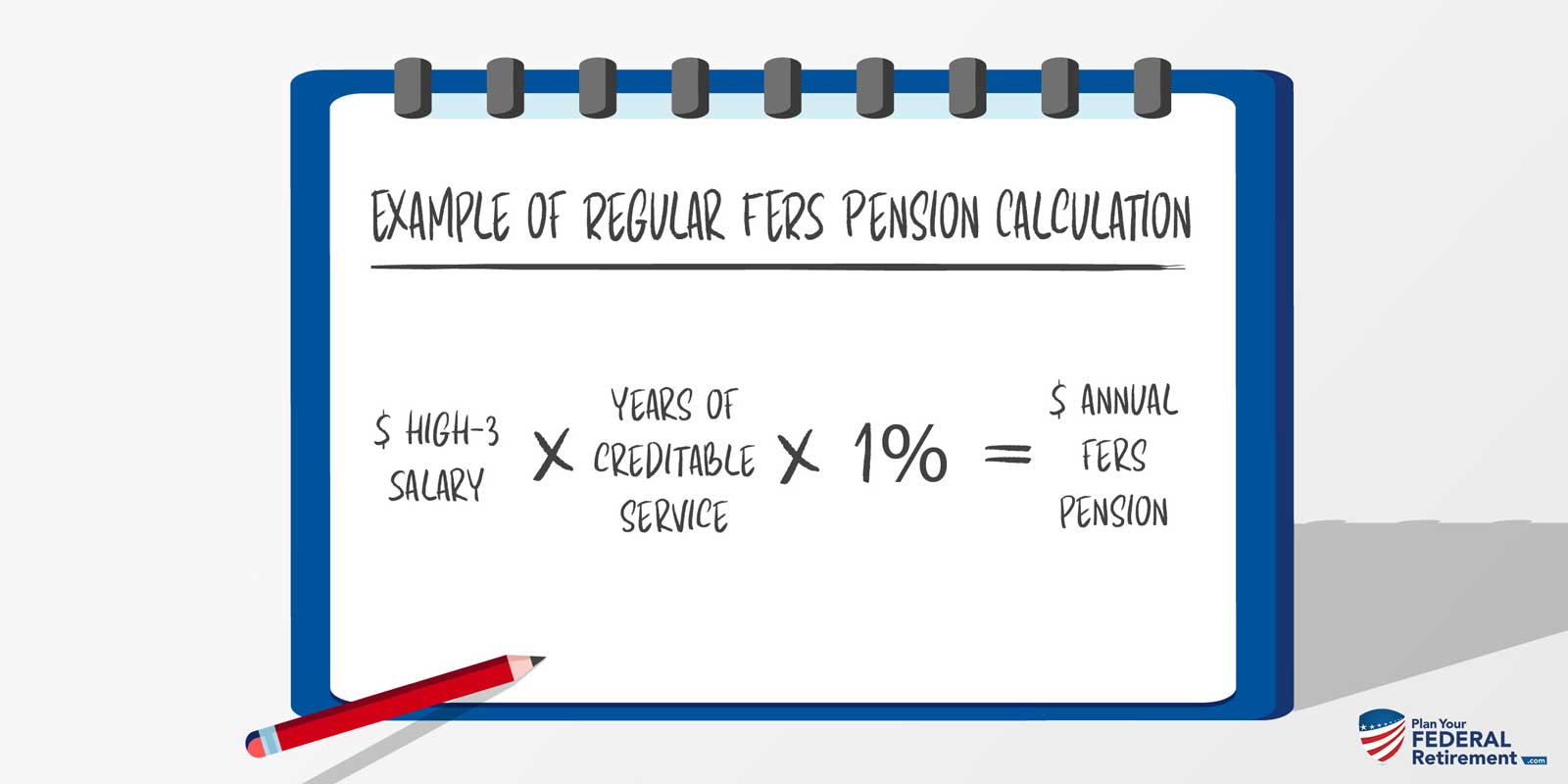

For most federal employees your pension is a big part of your retirement. Paper Short Forms - MO-1040A. Plan Your Federal Retirement is not employed by the United States Federal Government and does not represent the United States Federal Government.

If you choose to file a paper return you can use. Under the current rules your monthly Social Security benefits are reduced by 2 for every 3 you receive from your monthly government pension income. The Federal Employees Retirement System FERS was established by Public Law 99-335 in Chapter 84 of title 5 US.

The Federal Employees Retirement System FERS The FERS Basic Benefit Plan is a defined benefit plan for federal employees hired after December 31 1983. Use the Internal Revenue Service IRS online tool and online publication to find out. While its unlikely you could lose your pension if your former company goes bankrupt and you elect monthly payouts.

The https ensures.

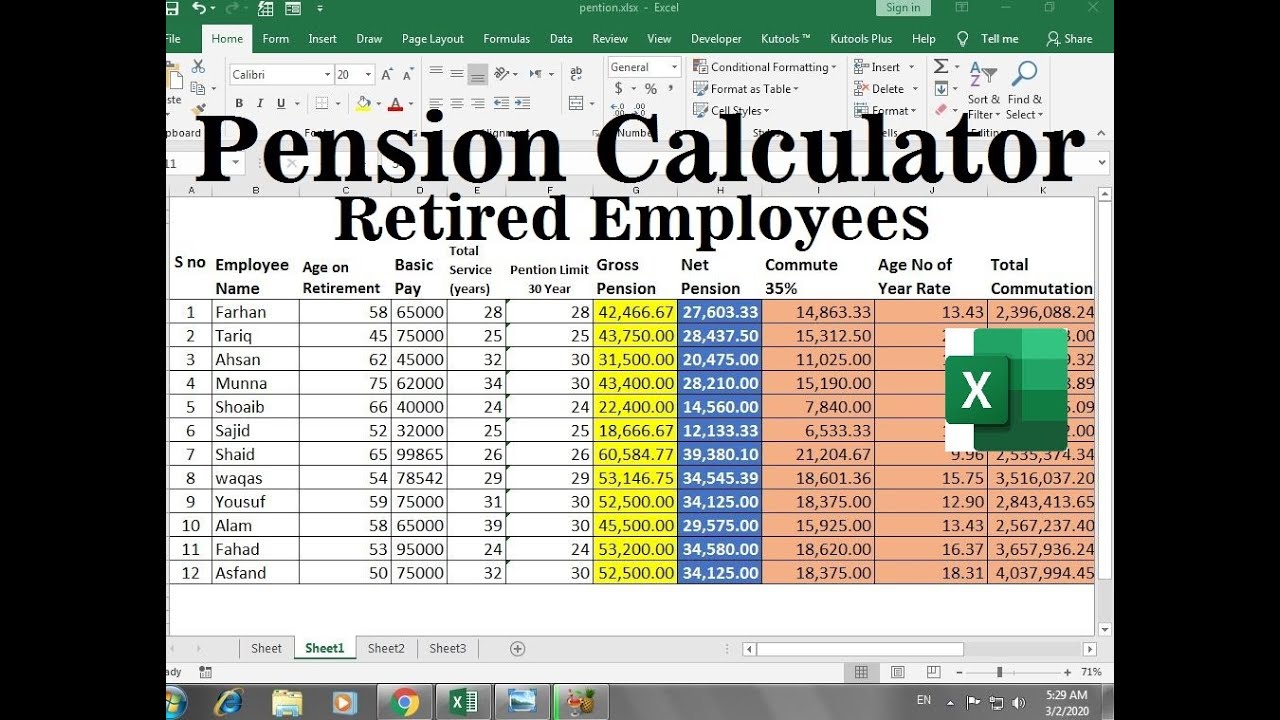

Pension Calculator 2021 22 Updated How To Calculate Pension Of Various Years Automatic Pension Calculation Sheet 2022

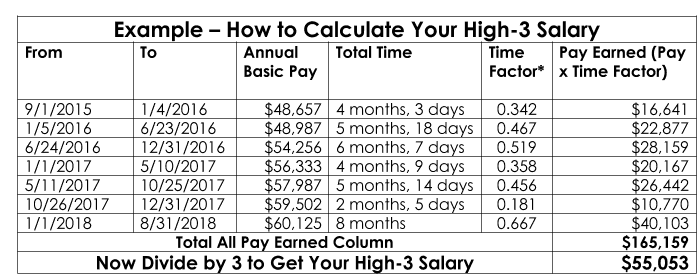

Your High Three Estimate In Our Fers Calculator Retirement Benefits Instituteretirement Benefits Institute

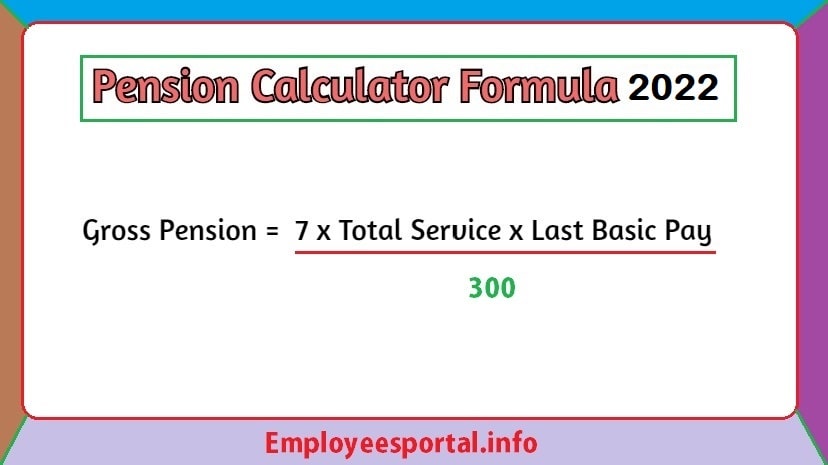

Calculation Formula For Pension And Commute

Pension Calculator 2022 Sindh Pensioners Galaxy World

Pension Calculator For Federal Provincial Govt Employees

Pension Calculator Formula 2022 Employeesportal

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service

Pension Calculator Pakistan Free Download And Software Reviews Cnet Download

Pension And Commutation Calculator In Excel For Retired Employees Youtube

Pension Calculator 2021 22 Federal Punjab Sindh Balochistan And Kpk

How To Calculate Your High 3 Salary Plan Your Federal Retirement

Pension Calculator 2019 20 For Federal And Provincial Govt Pensioners

1 Benefit Formula For Calculating Pension And Gratuity In Respect Download Table

Pension Calculator 2021 22 Updated How To Calculate Pension Of Various Years Automatic Pension Calculation Sheet 2022

Pension Calculator 2021 22 Updated How To Calculate Pension Of Various Years Automatic Pension Calculation Sheet 2022

Pension Calculation Formula With Easy Steps Manually Jobsgar

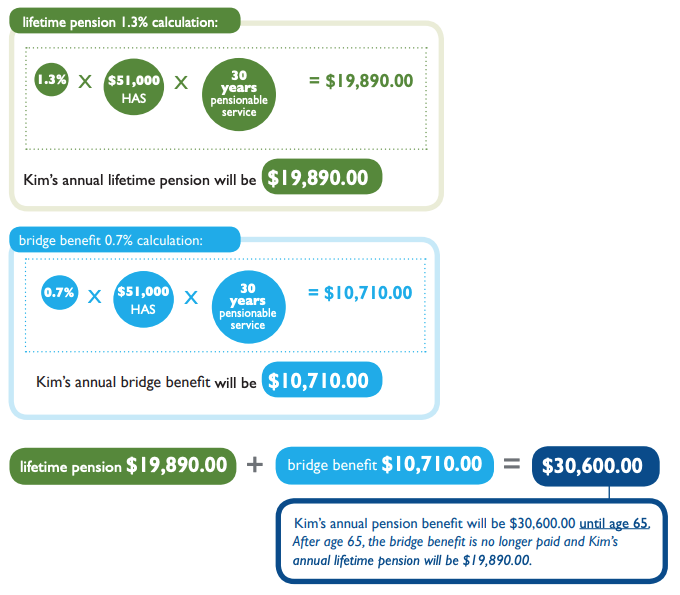

How Your Pension Is Calculated Nova Scotia Public Service Superannuation Plan